2022 tax refund calculator canada

TurboTax free Canada income tax calculator for 2022 quickly estimates your federal and provincial taxes. Canada Tax Calculator 202223.

The calculator reflects known rates.

. Calculate the tax savings your RRSP contribution generates in each province and territory. You can also create your new 2022 W-4 at the end of the tool on the tax. Find out your tax refund or taxes owed plus federal and provincial tax rates.

This means that you are taxed at 205 from. 2022 Income Tax in Canada is calculated separately for Federal tax commitments and Province Tax commitments depending on where the individual tax return is filed in 2022 due to work. Use the Canada Tax.

For example in the 2021 tax season if you earn 80000 you will be in the 49020 to 98040 tax bracket with a tax rate of 205. For TurboTax Live Full Service your tax expert will amend your 2021 tax return for you through 11302022. Use our free 2022 ontario income tax calculator to see how much you will pay in taxes.

That means that your net pay will be 37957 per year or 3163 per month. The canada tax calculator provides state and province tax return. Your best option is to speak with a tax.

The Canada Tax Calculator by iCalculator is designed to allow detailed salary and income tax calculations for each province in Canada. Calculations are based on rates known as of September 29 2022 including Alberta 2022 indexation. This tax calculator will be updated during 2022 as new 2022 IRS tax return data becomes available.

Calculate your combined federal and provincial tax bill in each province and territory. 2022 Tax Return Calculator Canada. For example if your non-refundable credits total 20000 and your taxable income is 40000 you are in the first tax.

Calculate the tax savings your RRSP. Here is a list of credits based on the province you live in. 2022 Personal tax calculator EY Canada 2022 Personal tax calculator Calculate your combined federal and provincial tax bill in each province and territory.

Your average tax rate is. The tax calculators are designed to be simple requiring no more than entering your earnings. The canada tax calculator provides state and province tax return calculations based on the 20212022 federal and state tax tables.

Assumes RRSP contribution amount is fully. After 11302022 TurboTax Live Full Service customers will be able to amend their. 2022 Tax Calculator Select your province Employment income Self-employment income Other income CRB EI CPPOAS Capital gains Eligible dividends Ineligible dividends.

You can use advanced features to provide a bespoke tax return tax refund example and email this. Reflects known rates as of June 1 2022. 2022 tax brackets except AB and most tax credits have been verified to Canada.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043.

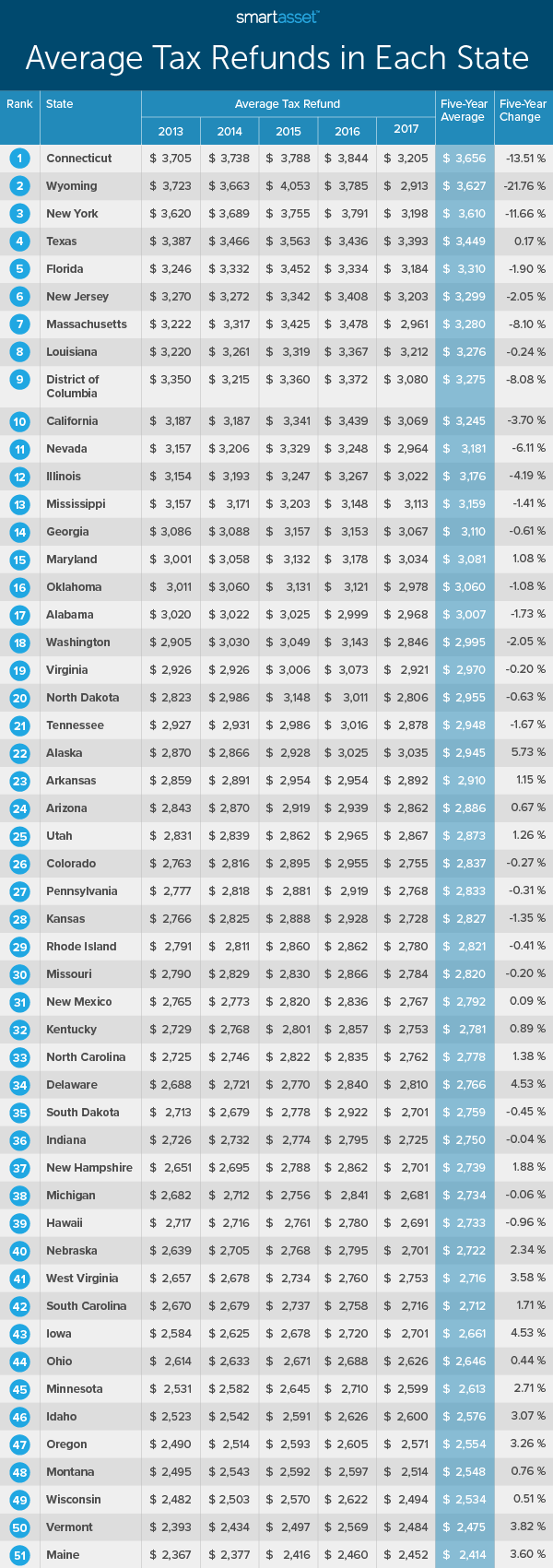

Tax Refunds In America And Their Hidden Cost 2020 Edition

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

Ey 2022 Tax Calculators Rates Ey Canada

Canadian Credit Report Photos Free Royalty Free Stock Photos From Dreamstime

Property Tax Calculator Estimator 2022 Wowa Ca

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

2022 Canada Tax Filing Deadline What You Need To Know Compass Accounting

2022 Canada Income Tax Calculator Turbotax Canada

See Your Refund Before Filing With A Tax Refund Estimator

When Are Taxes Due In 2022 Forbes Advisor

Tax Refund Schedule 2022 How Long It Takes To Get Your Tax Refund Bankrate

Federal Income Tax Return Calculator Nerdwallet

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

2021 2022 Income Tax Calculator Canada Wowa Ca

Federal Income Tax Return Calculator Nerdwallet

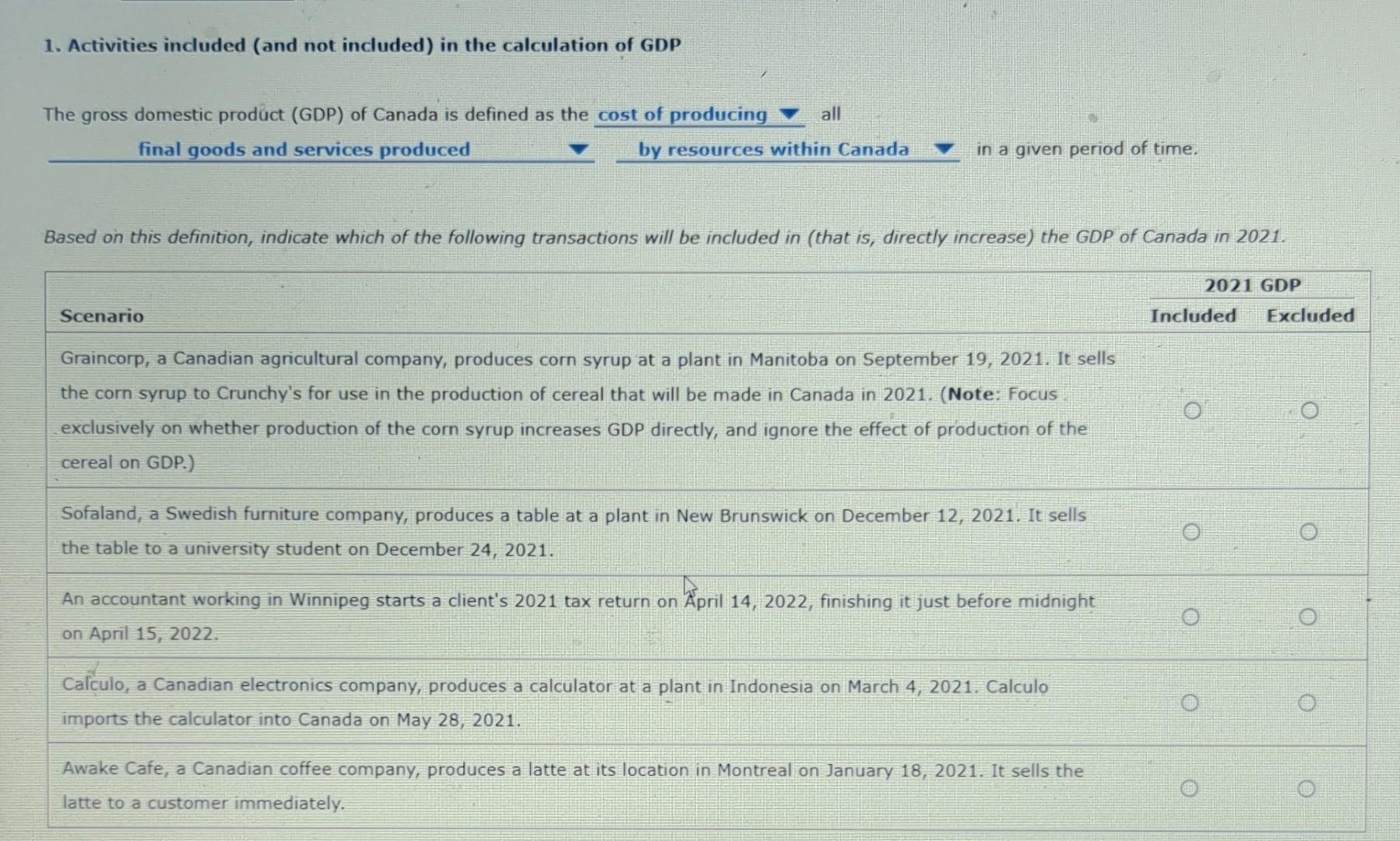

Solved 1 Activities Included And Not Included In The Chegg Com

Free Online Tax Filing E File Tax Prep H R Block

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download